are union dues tax deductible 2021

Union dues deduction The easiest way to get there is to type the words union dues in the Find window on the upper right hit enter and then click the Jump To below. Line 21200 was line 212 before tax year 2019.

Your 2020 Guide To Tax Deductions The Motley Fool

The union dues deduction was alive and well through the end of the 2017 tax year.

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

. 25 2021 443 pm ET. Annual dues for membership in a trade union or an association of public servants. Support for union dues deductions.

Generally expenses that may qualify for an itemized deduction include. The TCJA made union dues non-tax deductible. No employees cant take a union dues deduction on their return.

Union dues may be tax deductible subject to certain limitations. The House budget bill includes a 250 per worker write-off. Union dues may be deductible from California income taxes if you qualify to itemize on your California tax return.

Just keep going in that interview until you see the screen that allows you to enter the amount of union dues. Posted on 11262021 by Cal Skinner November 26 2021. The bill the House passed would allow union members to deduct up to 250 of dues from their tax bills.

Tax reform eliminated the deduction for union dues for tax years 2018-2025. Claim the total of the following amounts related to your employment that you paid or that were paid for you and reported as income in the year. Aee collected 423185 in dues and fees from its members in tax year 2019 according to reports the union must file with the irs.

However most employees can no longer deduct union dues on their federal tax return in tax years 2018 through 2025 as a result of the Tax Cuts and Jobs Act TCJA that Congress signed into law on December 22 2017. In April 2021 Sen. Bob Casey D-Pa said of a similar piece of proposed legislation Unions are the backbone of the middle class supporting workers wage growth and fair economic conditions.

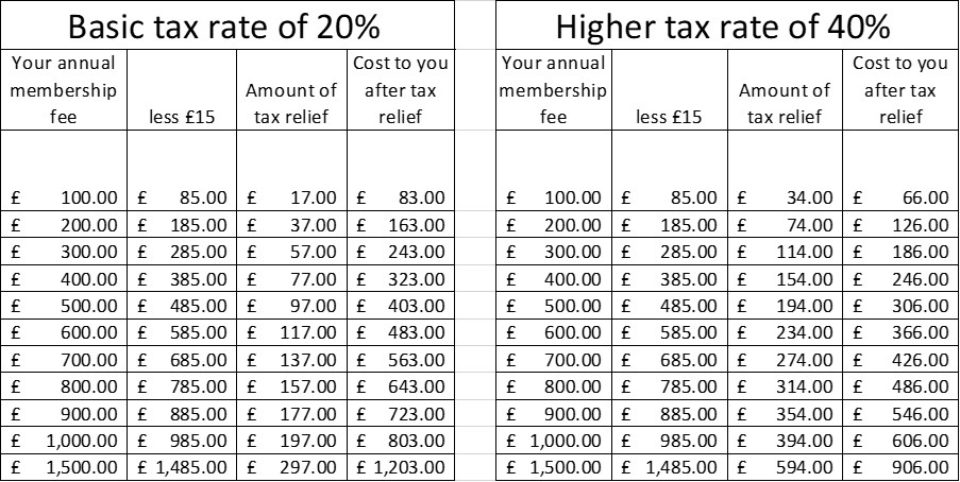

We have printed a chart you can use to compute the amount deducted on your behalf and remitted to the UFT. The 2019 tax season was the first time union members could no longer deduct the cost of items such as tools uniforms subscriptions to trade journals and many other items besides union dues that are often necessary for workers to do their jobs and earn a living. Prior to 2018 an employee who paid union dues prior may have been able to deduct them as unreimbursed employee business expenses if the total of the dues plus certain miscellaneous itemized expenses reached a certain level.

Why are union dues no longer deductible. Union dues are post-tax voluntary deductions and should be noted in that section of the paystub together with deductions for insurance deductions and 401k contributions. Some workers may be able to deduct eligible work-related expenses from their state income tax.

If a tax-exempt organization notifies you that part of the dues or other amounts you pay to the organization are used to pay nondeductible lobbying expenses you cant deduct that part. Many modern paystubs include not only the amount the the current pay periods deduction but also the amount deducted year-to-date. Bill Seeks to Make Union Dues Tax Deductible.

When union members. Prior to 2018 an employee who paid union dues may have been able to deduct unreimbursed employee business expenses including union dues. 31 2021 the City of New York and other employers deducted union dues for the UFT from those UFT members who were so designated.

You can deduct certain lobbying expenses if they are ordinary and necessary expenses of carrying on your trade or business. If youre self-employed you can deduct union dues as a business expense. This publication explains that you can no longer claim any miscellaneous itemized deductions unless you fall into one of the qualified categories of employment claiming a deduction relating to unreimbursed employee expenses.

These resources can help you determine which expenses are deductible as an unreimbursed business expense. During the year ending Dec. If you belong to a union or professional organization you can deduct certain types of union dues or professional membership fees from your income tax filings.

The amount of union dues that you can claim is shown in box 44 of your T4 slips or on your receipts and includes any GSTHST you paidYou can claim a tax deduction for these amounts on line. Tax code pro-worker lawmakers are fighting to bring it back and for the first time make it available without itemizing. A Tax Break for Union Dues.

The deduction is above the. Bill seeks to make union dues tax deductible may 2 2021 the 2019 tax season was the first time union members could no longer deduct the cost of items such as tools uniforms subscriptions to trade journals and many other items besides union dues that are often necessary for workers to do their jobs and earn a living. Professional board dues required under provincial or territorial law.

However most employees can no longer deduct union dues on their federal tax return in tax years 2018 through 2025 as a result of the Tax Cuts and Jobs Act TCJA that Congress signed into law on December 22 2017. Four years after the income tax deduction for union dues was ripped out of the US. However if the taxpayer is self-employed and pays union dues those dues are deductible as a business expense.

Tax reform changed the rules of union due deductions. Keep in mind state and federal rules differ. Union dues you can deduct dues and initiation fees you pay for union membership.

For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can itemize deductions. The states official tax instruction book confirms union dues can still be deducted from state taxes subject to itemizing and if your miscellaneous. As a result of the Tax Cuts and Jobs Act TCJA that Congress passed and was signed into law on December 22 2017 employees can no longer deduct union dues from their federal income tax in years 2018-2025.

New Bill Would Restore Tax Deduction for Union Dues Other Worker Expenses. When you think the playing field could not be more unbalanced A Tax Break for Union Dues. In 2017 Republicans eliminated tax deductions for workers and instead gave massive tax cuts for large.

Dems Plan Tax Deduction for Teacher Union Dues 9 Comments JT on 11262021 at 727 pm said.

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

Portugal Taxing Wages 2021 Oecd Ilibrary

Claiming Back The Tax On Your Pda Membership The Pharmacists Defence Association

With Stubcreator Com Reliable Pay Stubs Are Generated Instantly Which Are Available For Print At The Same T Good Essay Statement Template Cover Letter Sample

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

What Are Payroll Deductions Article

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

Different Types Of Payroll Deductions Gusto

Union Fees Are They Tax Deductible And What Are They Pop Business

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

Make Use Of All Those Tax Deductions Germany Has To Offer Sib

Amazing Way To Take Health Insurance As A Tax Deduction In 2021 Tax Deductions Health Insurance Deduction

Bill Seeks To Make Union Dues Tax Deductible Iam District 141

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

Are You Missing Out On Educator Tax Deductions Or Covid Related Tax Relief Connecticut Education Association

A Tax Break For Union Dues Wsj

What Are Pre Tax And Post Tax Payroll Deductions Hourly Inc

What Is Payroll Deduction 7 Types And How To Calculate Payroll Payroll Taxes Deduction